will capital gains tax increase in 2021

The 238 rate may go to 434 an 82 increase. Currently there are four rates of CGT being 18 and 28 on UK residential property.

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Apr 23 2021 305 AM.

. Short-term gains are taxed as ordinary income. 22 of the last 30276. Posted on January 7 2021 by Michael Smart.

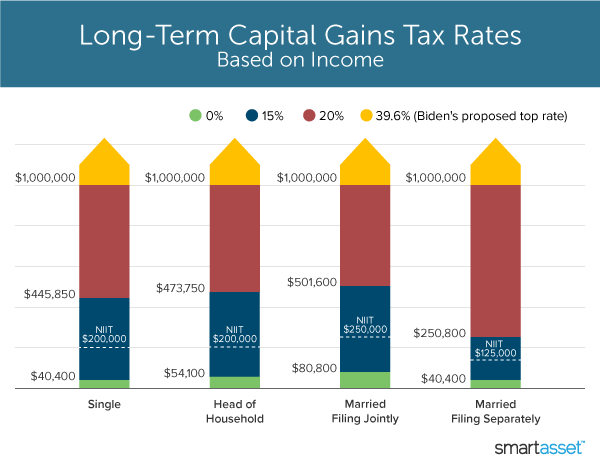

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Request a Payment Trace. Your 2021 Tax Bracket To See Whats Been Adjusted.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Does capital gains increase basis. As proposed the rate hike is already in effect for sales after April 28 2021.

The maximum capital gains are taxed would also increase from 20 to 25. Capital gains tax is likely to rise to near 28 rather. Simply put capital gains tax CGT is paid when an asset other than your main residence is sold at a profit.

Weve got all the 2021 and 2022 capital gains. This new rate will be effective for sales that occur on or after Sept. For long-term capital gains you fall into the 15 tax bracket so you calculate your long-term.

Ad New York residents can invest in Silicon Valley real estate near future tech campuses. Ad Compare Your 2022 Tax Bracket vs. This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax.

12 of the next 31499 of income. Enjoy low prices on earths biggest selection of books electronics home apparel more. The over-55 home sale exemption was a tax law that provided homeowners over the age of 55 with a one-time capital gains exclusion.

See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Capital gains tax rates on most assets held for a year or less. The IRS taxes short-term capital gains like ordinary income.

At what income level do you not pay capital gains tax. Capital gains tax could double in 2021 or 2022. Ad New York residents can invest in Silicon Valley real estate near future tech campuses.

By Curious and Calculated April 29 2021 2 Comments. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Note that short-term capital gains taxes are even higher.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to. Currently the top federal tax rate is 238 and could jump to 434. If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in the 2021 or 2022 tax year.

2 days agoNew data published today by HMRC has revealed that in the 2020 to 2021 tax year the total amount of Capital Gains Tax CGT liability was 143 billion for 323000 taxpayers. Its time to increase taxes on capital gains. Those with less income dont pay any taxes.

The maximum capital gains are taxed would also increase. Ad If youre one of the millions of Americans who invested in stocks. The effective date for this increase would be September 13 2021.

Add state taxes and you may be well over 50. The proposal would increase the maximum stated capital gain rate from 20 to 25. Read customer reviews find best sellers.

Will capital gains go up in 2021. While it is possible Congress could make any capital gains tax increase retroactive any increase will likely not be effective until 2022. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

More broadly because capital gains taxes could jump significantly for those with an income of over 1 million planning now could save a lot of money. Learn More About The Adjustments To Income Tax Brackets In 2022 vs. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

But because the higher tax rate as. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Will capital gains tax increase in 2021.

If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. Then you will pay.

See why Urban Catalyst is a trusted leader in opportunity zone fund investing. To address wealth inequality and to improve functioning of our tax. Ad Browse discover thousands of brands.

Individuals who met the requirements could exclude. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Capital Gains Tax What Is It When Do You Pay It

What S In Biden S Capital Gains Tax Plan Smartasset

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)